Africa’s venture market is growing, just not for women

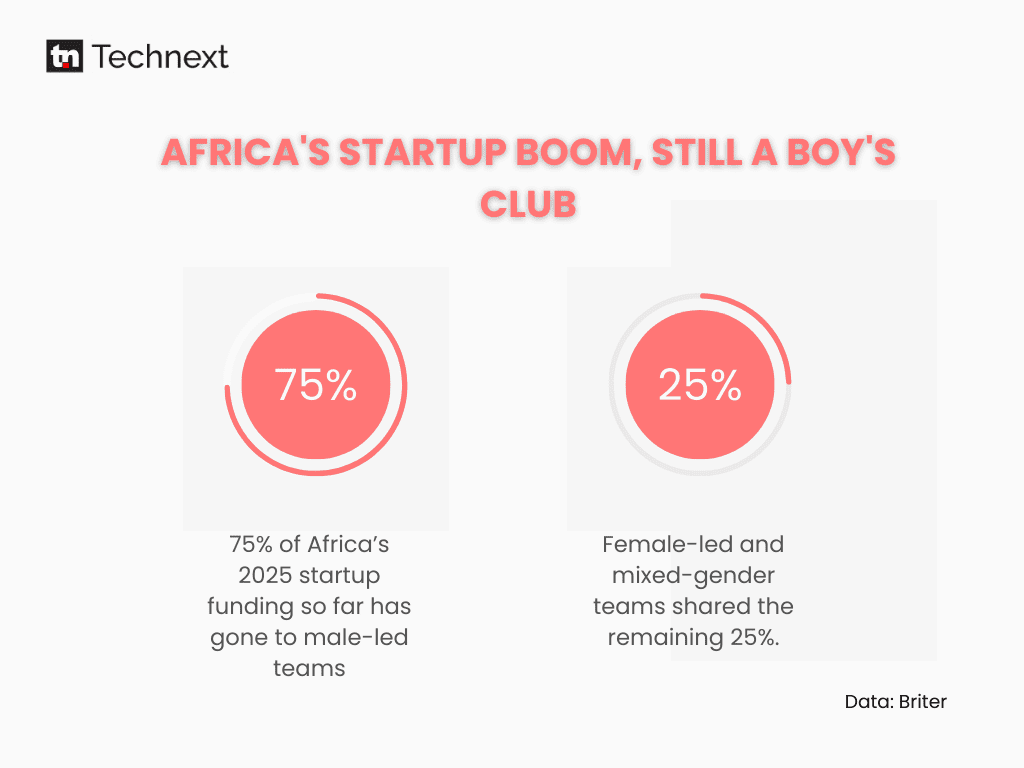

In 2025, three out of every four venture dollars in Africa have gone to male-led startups. According to Briter’s latest report, 75% of all funding raised so far this year flowed to companies founded and run primarily by men, while women-led and mixed-gender teams shared the remainder.

The imbalance is not new. Over the past five years, male-led teams have consistently captured nearly 90% of total funding on average, a pattern that has barely shifted even as Africa’s venture market has expanded beyond $2 billion in 2025, with over 500 deals and a median deal size above $1 million.

In other words, while the ecosystem is evolving – bigger checks, fewer deals, new instruments like debt surpassing $1B for the first time – one constant is that women are still being left out of Africa’s capital flows.

Interestingly, the number of transactions has steadily declined since the 2021–2022 bubble, but those that close are larger, driving the median deal size back to 2022 levels.

Cleantech’s surge, nearly $950 million raised, largely through debt with $5 million median rounds, and Fintech’s dominance, $1 billion across 115+ deals, underline how capital is consolidating around asset-heavy and proven models.

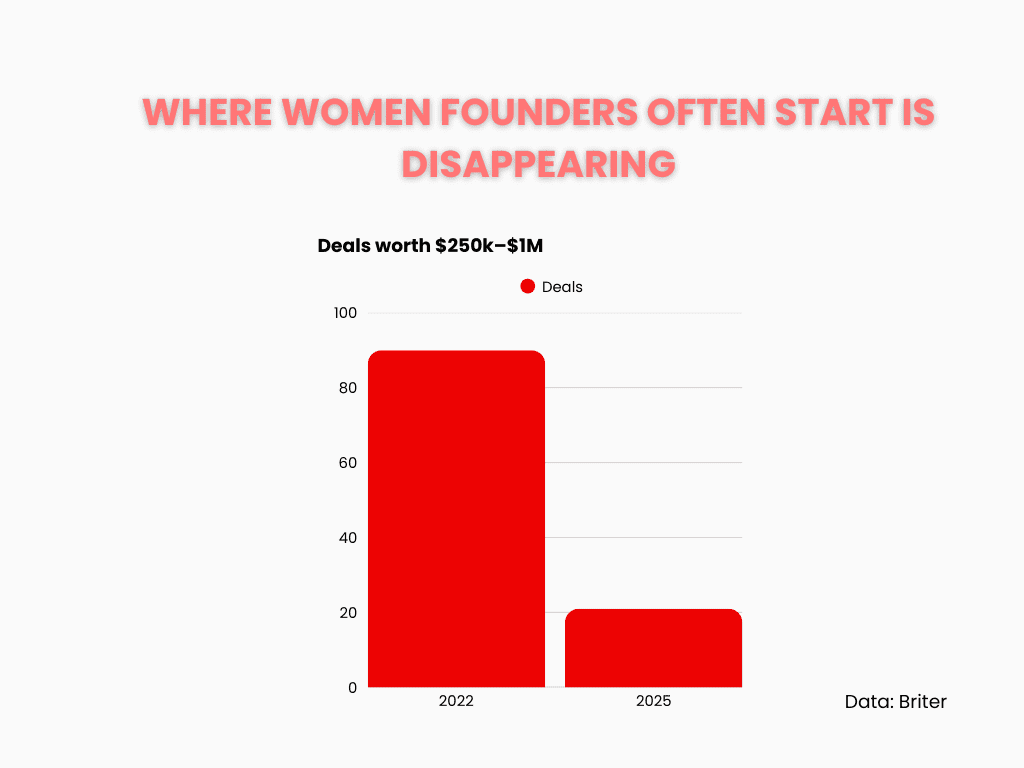

Investors are writing bigger checks, often in the tens of millions, while early-stage rounds have dried up: the $250,000–$1 million bracket fell from 90 deals in 2022 to just 21 this year.

At the very top, five companies raised $100 million or more in a single round, setting the tone for a market where size matters. Yet this evolution hides a stubborn truth.

Even as funding patterns change, the share captured by women-led teams has not. Growth in volumes, larger round sizes, and sectoral shifts have expanded the pie, but women founders are still struggling to get a meaningful slice.

What stands out in the charts is how little the distribution has shifted. Across both funding volume and deal count, the lines for male-led teams remain dominant year after year, while women-led and mixed-gender startups trace the same narrow band at the bottom of the graph.

Even in years of growth, contraction, or rebound, the proportions hardly move. This flatness is what makes the imbalance systemic. The venture ecosystem is dynamic in almost every other respect – sectors rotate, instruments shift, geographies rise and fall – but the gender split looks frozen in place. Progress in Africa’s venture scene is being measured in bigger checks and new instruments, not in broader inclusion.

Why it matters

The exclusion is compounded by the kinds of deals that are vanishing. In 2022, there were 90 transactions in the $250,000–$1 million bracket – the range where many female-led ventures first gain traction. By 2025, that number had collapsed to just 21 deals.

At the same time, investors leaned toward larger rounds for asset-heavy businesses, from solar projects to payment platforms, many of which were led by all-male teams.

Debt, which crossed $1 billion for the first time in 2025, flowed mainly into infrastructure-driven sectors where female participation is already limited.

Together, these shifts narrow the runway for women founders just as the market itself is expanding.

Implications

Africa’s venture market is maturing financially, but socially it remains stagnant. Bigger checks are flowing, new instruments are reshaping the landscape, and East and Southern Africa are taking the lead.

Yet the rebound of 2025 risks being built on exclusionary patterns that recycle the same biases of the past five years.

The ecosystem is proving it can adapt to shocks and reinvent financing models, but it has yet to prove it can broaden access to the capital that fuels this growth.

The question is no longer whether Africa can attract capital as 2025 has shown that it can. The more pressing question is if the continent affords a future where innovation and growth remain disproportionately male-led?

Addressing this gap is not simply about fairness. It is about tapping into markets, ideas, and founders that remain overlooked. Until funding flows reflect that reality, Africa’s venture boom will remain incomplete, no matter how high the totals climb.