Bitcoin Miners Begin Controlled Profit-Taking as Market Uptrend Strengthens

BULLISH

BULLISH

BTC

BTC

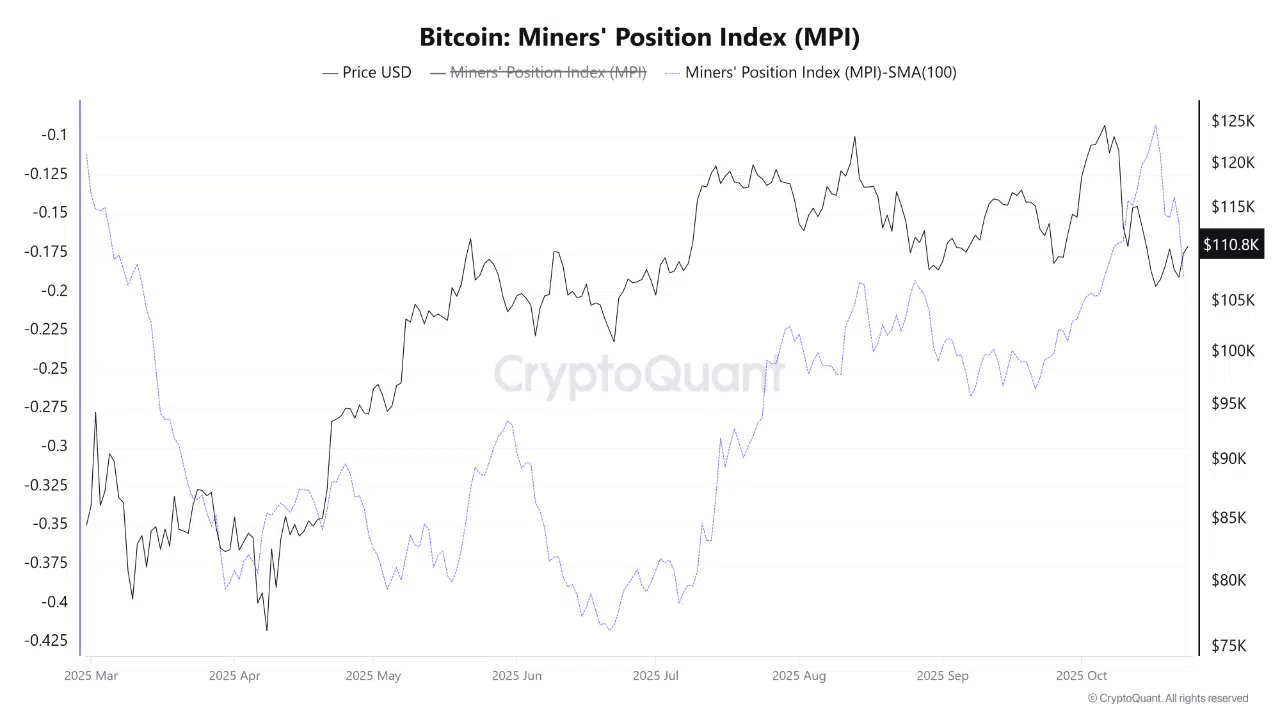

According to a new CryptoQuant report, Bitcoin miners are gradually shifting from deep accumulation to moderate profit-taking, a sign of normalization rather than weakness.

The firm’s Miners’ Position Index (MPI), adjusted by its 100-day moving average, climbed to -0.12 on October 17, marking its highest level since March 2025. While the index remains in negative territory, the steady rise from -0.41 in June signals a meaningful change in miner behavior as Bitcoin’s price holds above $110,000.

Rather than aggressively offloading holdings, miners appear to be selling modestly to realize profits and cover operational costs, a pattern typical in strong market uptrends. This gradual return to neutral selling pressure is considered healthy for Bitcoin’s price stability, as it introduces controlled liquidity without triggering steep drawdowns.

CryptoQuant emphasized that as long as the MPI stays below zero, miner activity is unlikely to threaten the market’s bullish structure. Instead, the ongoing moderation in miner accumulation supports a more sustainable rally, balancing supply with renewed investor demand.

With Bitcoin maintaining tight supply conditions, as noted in parallel Glassnode and Arab Chain reports, this miner normalization aligns with a broader narrative of orderly market maturation.

Rather than signaling exhaustion, the data suggests that Bitcoin’s current phase reflects measured optimism, where miners, long-term holders, and institutions are all adapting to a higher trading range ahead of potential new highs in Q4 2025.

The post Bitcoin Miners Begin Controlled Profit-Taking as Market Uptrend Strengthens appeared first on ETHNews.