Top 5 platforms to trade Nigerian stocks; see how to buy and sell

IDTT

IDTT

SEC

SEC

TOP

TOP

1

1

NVG8

NVG8

Gone are the days of the rotational savings (Ajo) or idle bank savings with little or no returns. Buying and selling Nigerian shares has become a viable form of investment for young people.

In this age, you have limitless opportunities to earn legitimately remotely using technology. Using online platforms, you can invest in various financial instruments like Stocks, Mutual Funds, Bonds, ETFs, Real Estate or Fixed Deposits and allow your money to work for you.

In this article, we will spotlight 5 platforms to trade Nigerian shares and provide a step-by-step guide on how to buy and sell.

From our research, these platforms are the most popular among Nigerians.

1. Bamboo

Founded: 2019

Founders: Richmond Bassey and Yanmo Omorogbe

Bamboo, a leading investment platform, allows Nigerians to invest in U.S. and Nigerian shares. Through the Bamboo app, you can buy, hold, or sell thousands of shares on the Nigerian Stock Exchange (NGX) and US stock exchanges (NASDAQ and NYSE).

Bamboo offers access to real-time market data and news updates.

With more than 500,000 users on the platform, Bamboo is licensed by the Nigerian and the United States Securities and Exchange Commission.

To kickstart your investment process, the minimum investment amount for Nigerian Stocks is N5,000. While there is no fractional investment option, you can buy at least 1 stock that is worth this amount or more.

To get started on the app, simply:

Download the app through the Google Play Store or App Store and create an account by passing the KYC using your Bank Verification Number (BVN) or National Identity Number (NIN).

Fund your wallet via multiple channels. You can use your local currency cards, and Bamboo will handle the currency conversion.

To buy Nigerian shares on Bamboo

Step 1: On the app’s homepage, tap “Invest” and then select “NG Stocks” at the top of the screen.

Step 2: Click on the search bar and type the name of the stock you wish to buy.

Step 3: Select the stock from the search results to view its details and tap the Buy button.

Note that fractional shares are not supported for Nigerian stocks, so you must purchase full shares.

Step 4: Enter the number of shares you want to buy. Then review the order to see the estimated total amount.

Step 5: If the details are correct, tap Place order.

To sell Nigerian shares;

Click on ‘NG Stocks’ on the app homepage, then click on the particular stock you wish to sell under the ‘My Stocks’ section. Click on the ‘Sell’ button to complete the sale and input the number of shares you want to sell. Review and submit the order to the stock market.

The funds from the sale will settle in 1 business day, and you can choose to either reinvest or withdraw the funds to your bamboo wallet, then to your domestic account.

Also Read: All you need to know about investing your pension funds yourself

2. Trove Finance

Founded: 2018

Founders: Oluwatomi Solanke, Desayo Ajisegiri, Austin Akagu, and Opeyemi Olanipekun.

The fintech company is popular for its diverse investment options, offering over 10,000 Nigerian and foreign stocks, ETFs, bonds, and cryptocurrencies.

On Trove Finance, you can start investing with as little as $10 or ₦1,000 across local and international markets, including major companies in Nigeria, the US, Europe, and China.

Trove offers a variety of assets that you can invest in, from global stocks to bonds. You can invest in over 4,000 stocks via the platform, including Nigerian shares listed on the Nigerian Stock Exchange (NGX).

According to the company, more than 400,000 investors trade on the platform with a record of over $150 million in trades.

To get started on Troove, your BVN, a valid means of identification such as a valid driver’s license, international passport, national ID card, or voters registration card, and other bio-data are required for signing up.

To buy Nigerian shares on Troove,

Step 1: Download the app and log in.

Step 2: Open an account.

Step 3: Switch your portfolio to the “Nigerian Portfolio”.

Step 4: Navigate to the “Explore” tab and select “Nigerian Stocks”.

Step 5: Search for the stock you want to buy.

To sell Nigerian shares;

Step 1: Open the Trove app and go to your portfolio section.

Step 2: Find and click on the specific stock you want to sell.

Step 3: Click on the “sell” button and choose a sell type:

- Market Sell: Executes the sale immediately at the current market price.

- Limit Sell: Lets you set a specific price that the shares must reach before they will be sold.

- Stop-Loss: A type of limit sell that triggers when the price drops to a certain point to limit losses (this is a type of limit sell).

Step 4: Choose to sell a specific number of shares, or a percentage of your holding (e.g., 25%, 50%, 75%, or 100%).

Step 5: Check the details of your order and then swipe or tap to confirm and place the sell order.

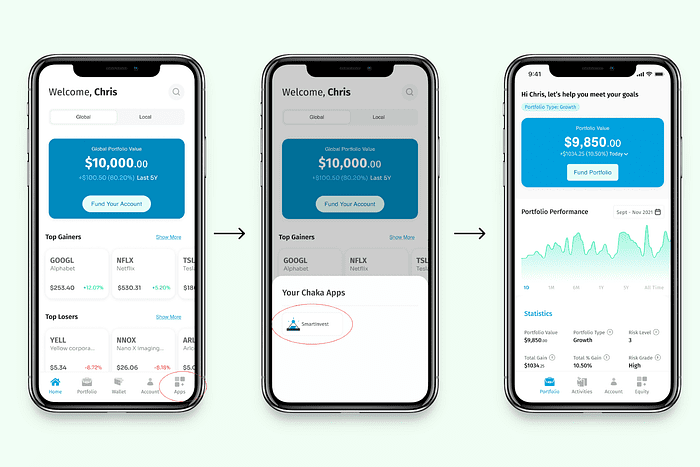

3. Chaka

Founded: 2019

Founder: Tosin Osibodu

Chaka provides Nigerians with access to around 4,000 foreign and Nigerian shares, making it an excellent choice for diversifying portfolios. It allows users to open dollar and naira accounts, giving them flexible investment management across different currencies.

All brokerage investments on the platform are facilitated by Citi Investment Capital Limited, a licensed Nigerian stockbroking firm registered with the Nigerian SEC.

To begin on the platform,

Download the app, register and supply the necessary details. You can then proceed to fund your wallet on Chaka.

To buy Nigerian shares on Chaka

Step 1: Click on the search icon in the top right-hand corner of the homepage and type the name or ticker of the stock you want. You can also browse the homepage for trending “market movers” and top-performing stocks.

Step 2: Enter the trade details

Step 3: After selecting a stock, tap the “Buy” button on the single stock page.

Step 4: Enter the number of shares you want to purchase. For market orders, you can also specify the estimated cost, and the quantity will adjust based on the final price.

Step 5: After entering the order details, place the buy order. You will receive an email confirmation with the final execution details. Your new shares will then appear in your portfolio.

To sell Nigerian shares,

Step 1: Navigate to your portfolio and find the specific Nigerian stock you want to sell from your holdings.

Step 2: Click on the stock at the “Stock Detail” screen, then tap the “Sell” button. This button is only visible if you own the stock.

Step 3: Enter the number of shares you want to sell and select the order type. You can choose between a “Market,” “Limit,” or “Stop” order.

Step 4: Review all the details of your sale order and tap “Confirm” to process the sale.

Also Read: Tax: Pensions, stipends, remote earnings of Nigerians in diaspora to be exempted – Taiwo Oyedele

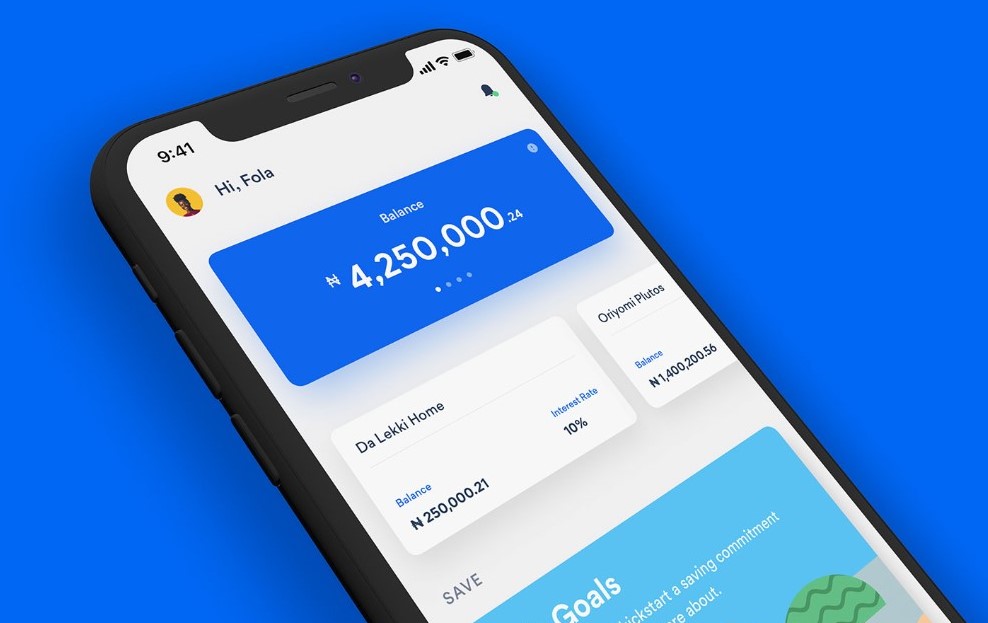

4. Cowrywise

Founded: 2017

Founders: Razaq Ahmed and Edward Popoola

Cowrywise is a Nigerian fintech company and digital wealth management platform that provides automated savings and investment services. The platform offers access to a diverse mutual funds, including naira and USD-denominated options.

On the platform, users can buy and sell stocks of over 140 companies listed on the Nigerian Stock Exchange directly through the app.

Cowrywise is a fund manager registered and licensed by the SEC of Nigeria.

To buy Nigerian shares on Cowrywise,

Step 1: Log in to the Cowrywise mobile app and click on the Invest tab.

Step 2: On the investment screen, select NG Stocks.

Find your desired stock. You can either search for a specific company or explore the available Nigerian stocks.

Step 3: Select the stock you want to buy, and then tap the Buy button.

Step 4: Enter the quantity of the Nigerian shares you wish to purchase. The minimum order amount is ₦5,000.

Step 5: Review your order details, which include the share price, total cost, estimated fees, and any buffer required. Then, click ‘Buy Now’ to confirm your order.

Step 6: Fund your transaction by choosing your payment method. You can pay via bank transfer, a linked bank account, or your Cowrywise Stash.

To sell your Nigerian shares

Step 1: Navigate to the Invest tab on your home screen and select NG Stocks to view your Nigerian stock portfolio.

Step 2: Click on the specific stock you want to sell from your list of holdings.

Step 3: On the stock’s detail page, click on the “Sell” button and enter the number of Nigerian shares you wish to sell.

Step 4: Choose the portfolio to sell from, if you have more than one.

Step 5: Review your order details and confirm the sale to process your order.

5. Afrinvest

Founded: 1995

Founders: Godwin Obaseki

Afrinvest is a Nigerian capital market holding company that provides a range of financial services, including investment banking, asset management, and securities trading.

It provides professionally managed investment products like mutual funds (Afrinvest Dollar Fund, Afrinvest Equity Fund), managed portfolios, and treasury bills for individuals and high-net-worth clients.

On the platform, investors can buy and sell securities, including stocks (local and international), bonds, and commercial papers, via its online platform and brokerage services.

Afrinvest Securities Limited (“ASL”) is licensed by the SEC as a broker-dealer and is authorised by the Nigerian Exchange Limited(NGX) as a dealing member.

To buy Nigerian shares,

Download the Afrinvest app and register. After submitting your documents, a Central Securities Clearing System (CSCS) account will be created for you within 24 to 48 hours. This unique number is required for trading on the NGX and will appear in your profile.

Step 1: Log in to your account, click the “fund wallet” tab, and enter the amount you wish to deposit. You can add funds via bank transfer or card payment.

Step 2: Click on the “invest” tab from the sidebar and select Nigerian Stocks to view all available equities. You can either click on a specific company listed or select “All Stocks” to browse the full list.

Step 3: Select the company you want to buy.

Step 4: On the Stock Detail Screen, review the company’s information, including market statistics, buy/sell options, and related news, to make an informed decision.

Step 5: Click the Buy button and place your order. Enter the number of units you want to buy, specify the order type and confirm the purchase details.

Step 6: An order summary will be displayed. Review it carefully before clicking “Buy Now” to finalise the transaction.

To sell your Nigerian shares,

Step 1: Access your portfolio by tapping on the “Nigerian Stocks” section in the Afrinvestor app.

Step 2: Locate and select the stock you want to sell from your portfolio.

Step 3: Click on the “Sell” button and enter the quantity of shares you want to sell and choose your order type (Market or Limit).

Step 4: Review the order details and confirm the sale.

Things to note

1. The Nigerian stock market is open from Monday to Friday (excluding public holidays) between 10:00 am and 2:30 pm. Any trades placed outside of these hours will be fulfilled on the next trading day.

2. The NGX uses a T+3 settlement cycle, meaning it takes three business days for the funds from your Nigerian shares sale to clear and become available in your wallet for withdrawal.

3. The process is completely digital, removing the need for manual paperwork typically associated with stock trading.

4. All stock investing involves risk, and returns are not guaranteed. It’s recommended to do your own research and understand the companies you are investing in.